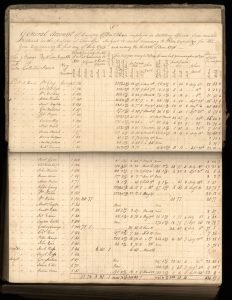

Blount County Tennessee Tax Lists

Tennessee tax lists typically list the names of white males over age 21 and will sometimes provide information about that person’s land, slaves, and other property. They may also include valuations. They can be useful both for locating an ancestor and providing an idea about his circumstances. 1801 Blount County Tennessee Tax List Online Blount County Tennessee Tax Records Ancestry.com, in partnership with the Tennessee State Library and Archives, has added an index to and scanned images of Tennessee tax records for the years 1783 – 1895. The indexes to these records at Ancestry.com’s Tennessee State Library and Archives web … Read more